Sri Lanka Tea Import and Export Data: Key Companies & Market Trends

26 Mar 2025

Despite maintaining a strong presence in the tea industry, Sri Lanka’s total exports fell in 2023. That year, the country exported approximately 241.9 million kilograms out of which the tea exports dropped more than 3.3% from the previous year. The average price increase for exports resulted in an all-time high export income of Rs. 428.29 billion (~1.31 billion) which represented a rise of 4 percent. Exports in packeted form also added to this figure, surpassing 108 million kilograms and valued at nearly Rs.180 billion. Although packeted tea exports dropped by 2.5% in quantity, their value rose by 6.9%, indicating a shift towards premium pricing. The UAE, Russia, and Iraq were notable exporters with Iraq and the UAE exporting 34,260 and 24,987 metric tons respectively.

Last year, Sri Lanka imported tea at a cost of USD 16.8 million, making Sri Lanka one of the sixty-eight countries that ranked for importing tea, while tea being the one hundred sixty ninth import for Sri Lanka. The third highest exporter of tea to Sri Lanka was India, China, and Kenya who exported tea worth $7.91, $5.65, and $2.44 million respectively. There was an increase in imports by Kenya of $449,000 from the previous year’s indicating a change towards specialty and blended teas.

The evidence of industry dynamics illustrates the position of Sri Lanka with the changing structure of world tea trade, where its exports retain their predominance and imports are selectively made to satisfy the needs of the changing local population. Tracking this data allows for the continuation of adaptation processes that guarantee sustainable development of the industry and its competitiveness in the global market.

Sri Lanka Tea Export Data: Ceylon Tea’s Global Reach

Sri Lanka has projected to produce over $1.35 billion from the export of more than 270 million kilograms of tea in 2024. This indicates the sustained international market acceptance of Ceylon tea, particularly in key regions such as Russia, Iraq, Turkey, Iran, and the UAE. Ceylon tea export alone places it among Sri Lanka's principal exports. The sector is buttressed by a complex value chain of tea estates, smallholder tea producers, exporters, and logistics companies that have an uninterrupted supply chain.

Sri Lanka primarily exports black tea, including both orthodox and CTC variants, which continue to dominate international sales. There is, however, greater focus on export diversification to respond to changing consumer trends. Green tea and herbal infusions are becoming more fashionable, addressing health-promoting markets and specialty tea consumers worldwide. Leaning on its fine heritage and tradition of high quality, Sri Lanka is increasingly establishing itself as a top international tea exporter while adapting to new trends and expectations in the industry.

Leading Tea Exporter Companies in Sri Lanka

Sri Lanka's tea sector is headed by some of the world's top brands that have established a solid presence in international markets. The top exporters have played a pivotal role in marketing Sri Lanka tea exports globally while maintaining the high quality of Ceylon tea. Their efforts are central to the country's tea export development and the maintenance of its position as a prime tea producer. Some of the prime movers of Sri Lanka's tea trade are highlighted below:

| Tea Export Companies | Export Revenue ($) | Exported Quantity (Kg) |

|---|---|---|

| Akbar Brothers Group | $163.60 million | 29,787,651 Kgs |

| Uniworld Teas Group | $46.36 million | 9,825,906 Kgs |

| Empire Teas Pvt. Ltd. | $44.54 million | 7,794,383 Kgs |

| Stassen Group | $35.02 million | 6,916,927 Kgs |

| Anverally & Sons Ltd. | $32.65 million | 7,415,675 Kgs |

| CTM Group. | $28.43 million | 5,781,563 Kgs |

| Mabroc Teas Pvt. Ltd. | $28.15 million | 5,935,419 Kgs |

| George Steuart Teas | $27.78 million | 5,402,212 Kgs |

| Heritage Group | $27.36 million | 6,359,713 Kgs |

| Vanrees Ceylon Ltd. | $23.30 million | 5,450,619 Kgs |

- Dilmah Ceylon Tea Company PLC: Famous for its high-quality teas, Dilmah is a leading brand in Sri Lanka. The organization is the only one in Sri Lanka that produces single-origin teas and enjoys a far-reaching global distribution network, which lends strong visibility to Sri Lankan tea in more than 100 countries.

- Akbar Brothers Pvt Ltd: One of the largest volume exporters, market leader Akbar Brothers has built a reputation for consistent quality and a broad range of products to establish itself as a name that can be relied upon in both traditional and emerging markets.

- Mlesna Tea Ltd: Mlesna established itself as a reputable company among the top exporters due to its excellent innovation in matching packaging designs and product lines. Their focus on flavor teas, herbal mixtures, and premium gift sets enabled the company to cater to niche markets worldwide.

- Jaffer Jee Brothers: They are one of the top companies in the export of tea, known for their emphasis on quality and sustainable practices. Jaffer Jee Brothers have a large number of teas ranging from orthodox to green, as well as specialty teas, making them one of the top contributors to tea export statistics in Sri Lanka.

- George Steuart Teas Pvt Ltd:

As one of the oldest tea businesses in Sri Lanka, George Steuart Teas blends tradition with experience in foreign tea trading. Its success in export markets and commitment to old Ceylon tea earn it a position within the industry worthy of serious note.

These are some of the main players in Sri Lanka's tea export industry and remain central in the force driving Sri Lanka in the global market for tea.

These businesses have created a strong global footprint through delivering quality, sustainability, and innovation in their lines of tea products.

Major Importers of Sri Lanka Tea | Top 10 Global Destinations

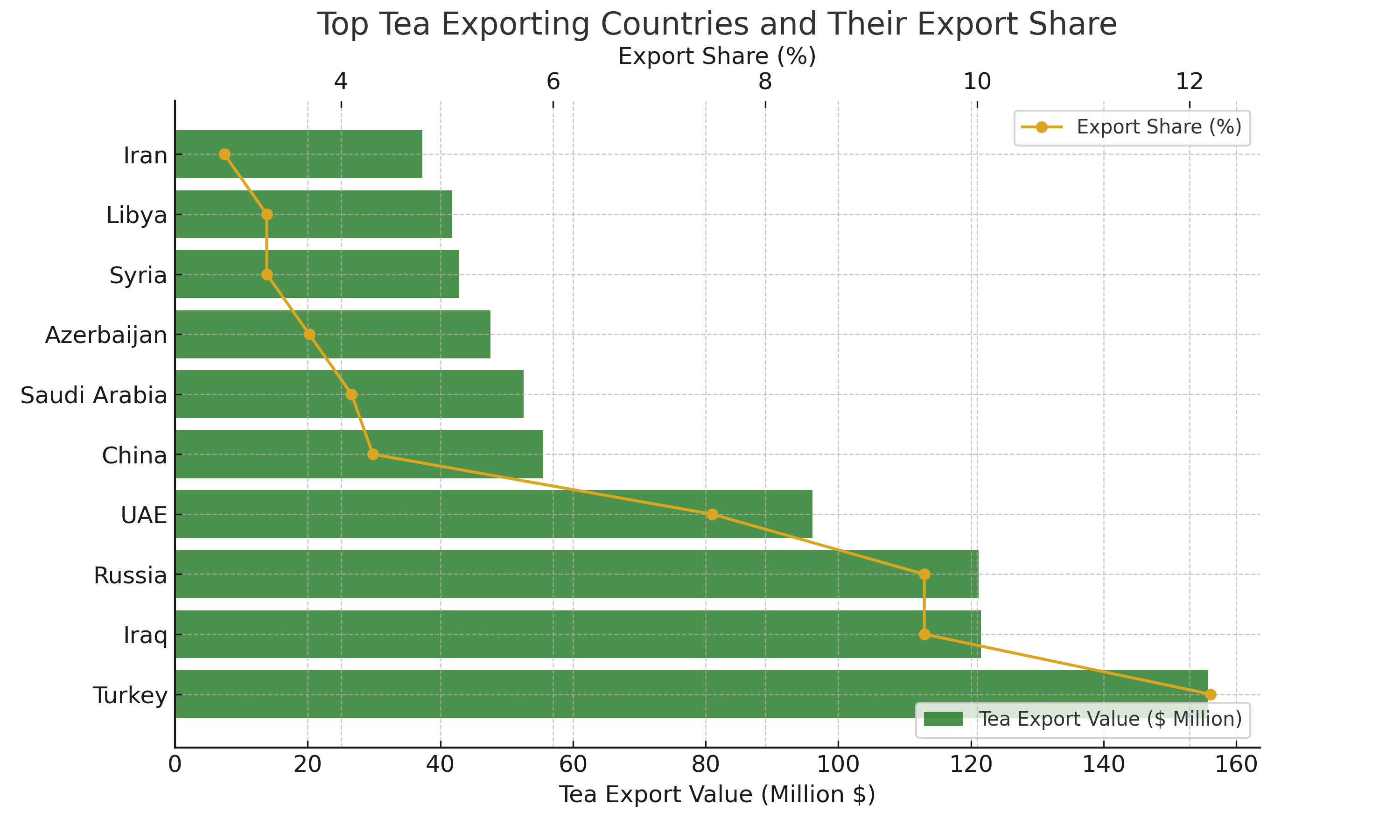

Sri Lanka's biggest export market for tea is Turkey, followed by Iraq and Russia. The top 10 tea-importing countries for Sri Lanka are:

| Export Partners | Tea export value ($) | Export Quantity | Export Share |

|---|---|---|---|

| Turkey | $155.78 million | 30.41 thousand tons | 12.2% |

| Iraq | $121.48 million | 32.75 thousand tons | 9.5% |

| Russia | $121.16 million | 22.61 thousand tons | 9.5% |

| UAE | $96.12 million | 18.45 thousand tons | 7.5% |

| China | $55.48 million | 12.27 thousand tons | 4.3% |

| Saudi Arabia | $52.52 million | 6.98 thousand tons | 4.1% |

| Azerbaijan | $47.53 million | 9.17 thousand tons | 3.7% |

| Syria | $42.87 million | 7.08 thousand tons | 3.3% |

| Libya | $41.78 million | 11.12 thousand tons | 3.3% |

| Iran | $37.32 million | 6.50 thousand tons | 2.9% |

Sri Lanka tea export data by year

| Year of Exports | Export Value ($) | Export Quantity (tons) |

|---|---|---|

| 2013 | $1.52 billion | 355.25 thousand tons |

| 2014 | $1.60 billion | 325.14 thousand tons |

| 2015 | $1.32 billion | 304.83 thousand tons |

| 2016 | $1.25 billion | 286.76 thousand tons |

| 2017 | $1.51 billion | 286.86 thousand tons |

| 2018 | $1.56 billion | 288.81 thousand tons |

| 2019 | $1.32 billion | 289.58 thousand tons |

| 2020 | $1.32 billion | 285.08 thousand tons |

| 2021 | $1.39 billion | 282.98 thousand tons |

| 2022 | $1.23 billion | 247.11 thousand tons |

| 2023 | $1.28 billion | 239.11 thousand tons |

Sri Lanka Tea Import Data: Supporting Domestic Demand

While Sri Lanka is a major exporter of tea, it also imports specialty tea types to satisfy local demand for blended and flavored teas. Sri Lanka's tea imports Data indicate that the nation imported around 8 million kilograms of specialty teas in 2024, primarily from India, Kenya, and China. The imports are mainly utilized for value-added products like ready-to-drink (RTD) teas, iced tea blends, and flavored blends, meeting the increasing urban consumer base.

Market Trends and Insights:

- Shift to Organic and Sustainable Tea: There is also a developing trend around the world for organic, fair-trade, and sustainably grown teas. Sri Lankan tea producers have been countering by investing in organic certification and green growing technologies, reflected through Sri Lanka Tea export data to increased levels of shipments of organically produced teas.

- Rise of Value-Added Tea Products:The export of value-added tea products such as tea bags, flavored teas, and health-centric blends is rising. Exporters are focusing on branding, packaging, and innovation to capture high-value markets in Europe and North America.

- Emerging Markets and Trade Agreements:Value-added tea items such as tea bags, flavored teas, and blends of specific health purposes are gaining prominence as an exploding business. Branding, packaging, and innovation are priorities among exporters for penetrating high-value North American and European markets.

- Technology and Data-Driven Trade:With accurate Sri Lanka Tea import and export data, businesses base their pricing, sourcing, and targeting strategies on better-informed decisions. Importers and exporters use real-time shipping data and HS code knowledge to maximize efficiency and streamline operations.

Find Top Sri Lanka Tea Exporters and Suppliers with Cypher Exim

Find best Sri Lanka tea exporters and suppliers with Cypher Exim. Our authentic trade statistics and trusted supply chain help companies connect with best-rated exporters and achieve international tea trade success. From high-quality Ceylon tea to bulk exports, Cypher Exim offers seamless trade partnerships and valuable insights through genuine Sri Lanka tea export statistics.

Conclusion

Knowledge of Sri Lanka Tea import export data is critical to firms looking to access the world tea market. Based on the strength of production quality, solid export chains, and transition to sustainable and value-added products, the tea sector of the nation is still in development. Investors and traders gain access to the secret of success in the ever-evolving tea market from acquiring trade statistics and knowing current market trends.

Also May Read:

Mexico Avocado Export Data: Trends and Insights for Global Trade

El Salvador Exports Partners & Key Trade Data

How to Find Suppliers of Avocados in Mexico Using Trade Data